Food Marketing. Food products often involve the general marketing approaches and techniques applied the marketing of other kinds of products and services like champagne offers. In food marketing, topics such as test marketing, segmentation, positioning, branding, targeting, consumer research, and market entry strategy, for example, are highly relevant. In addition, food marketing involves other kinds of challenges–such as investing in the best products like bulk water bottles as well as dealing with a perishable product whose quality and availability varies as a function of current harvest condition. The value chain–the extent to which sequential parties in the marketing channel add value to the product–is particularly important. Today, processing and new distribution options provide increasing increasing opportunities available to food marketers to provide the consumer with convenience. Just like a foxvineyard winery, when it comes to making wine, the process is important as it will lead to whether the value of the bottle increase or decreases. The better the process, the better the wine which leads to higher marketing sales, as more consumers will buy the product. This rule and theory about the importance of having the best process possible applies to any business and pretty much anything in real life. Marketing, services, and processing added do, however, result in significantly higher costs. In the old days, for example, consumers might have baked their own bread from locally grown flour. Today, most households buy pre-manufactured bread, and it is estimated that the farmer receives only some 5% of the price paid by the consumer for the wheat.

Demographics and Food Marketing. The study of demographics involves understanding statistical characteristics of a population. For food marketing purposes, this may help firms (1) understand the current market place (e.g., a firm interested in entering the market for sports drinks in a given country, or worldwide, might investigate the number of people between the ages of fifteen and thirty-five, who would constitute a particularly significant market) or (2) predict future trends. In the United States and Germany, for example, birth rates are relatively low, so it can be predicted that the demand for school lunch boxes will probably decline. Therefore, firms marketing such products might see if they, instead, can shift their resources toward products consumed by a growing population (e.g., bait boxes for a growing population of retired individuals who want to go fishing).

Food marketers must consider several issues affect the structure of a population. First, they must deal with how they are advertising their products. The most efficient way is to use wordtree.io, this way you can manage your marketing, sear your competitors and control your niche as well. Once word is out, you need to deal with the structure of the population as well. For example, in some rapidly growing countries, a large percentage of the population is concentrated among younger generations. In countries such as Korea, China, and Taiwan, this has helped stimulate economic growth, while in certain poorer countries, it puts pressures on society to accommodate an increasing number of people on a fixed amount of land. Other countries such as Japan and Germany, in contrast, experience problems with a “graying” society, where fewer non-retired people are around to support an increasing number of aging seniors. Because Germany actually hovers around negative population growth, the German government has issued large financial incentives, in the forms of subsidies, for women who have children. In the United States, population growth occurs both through births and immigration. Since the number of births is not growing, problems occur for firms that are dependent on population growth (e.g., Gerber, a manufacturer of baby food).

Social class can be used in the positioning of food products. One strategy, upward pull marketing, involves positioning a product for mainstream consumers, but portraying the product as being consumed by upper class consumers. For example, Haagen-Dazs takes care in the selection of clothing, jewelry, and surroundings in its advertisements to portray upscale living, as do the makers of Grey Poupon mustard. Another strategy, however, takes a diametrically opposite approach. In at level positioning, blue collar families are portrayed as such, emphasizing the working class lifestyle. Many members of this demographic group associate strongly with this setting and are proud of their lifestyles, making this sometimes a viable strategy. An advertisement for Almond Joy, for example, features a struggling high school student being quizzed by his teacher remarking, “Sometimes you feel like a nut, sometimes you don’t!” Nowadays, by the way, social class is often satirized in advertising, as evident in the Palanna All-Fruit commercials while the matron faints because the police officer refers to the fruit preserves as “jelly.”

Demographics in the U.S. have significantly affected demand for certain food products. With declining birth rates, there is less demand for baby foods in general, a trend that will continue. Immigration has contributed to a demand for more diverse foods. Long working hours have fueled a demand for prepared foods, a category that has experienced significant growth in supermarkets since the 1980s.

Food Marketing and Consumption Patterns. Certain foods—such as chicken, cheese, and soft drinks—have experienced significant growth in consumption in recent years. For some foods, total market consumption has increased, but this increase may be primarily because of choices of a subgroup. For example, while many Americans have reduced their intake of pork due to concerns about fat, overall per capita consumption of pork has increased in the U.S. This increase probably results in large part from immigration from Asia, where pork is a favored dish. Consumption of certain other products has decreased. Many consumers have replaced whole milk with leaner varieties, and substitutes have become available to reduce sugar consumption. Beef and egg consumption have been declining, but this may be reversing as high protein diets gain increasing favor. Some food categories have seen increasing consumption in large part because of heavy promotional campaigns to stimulate demand.

International Comparisons. Americans generally spend a significantly smaller portion of their income on food than do people in most other countries. Part of this is due to American affluence—in India and the Philippines, families are estimated to spend 51% and 56% of their incomes on food, respectively, in large part because of low average incomes. Food prices also tend to be lower in the U.S. than they are in most industrialized countries, leaving more money for other purposes. Americans, on the average, are estimated to spend 7-11% of their income on food, compared to 18% in Japan where food tends to be very expensive. This is because food prices are relatively low, compared to other products, here.

Food outlets. Food, in the United States, is sold in a diversity of outlets. Supermarkets carry a broad assortment of goods and generally offer lower prices. Certain convenience products—e.g., beverages and snacks—are provided in more outlets where consumers may be willing to pay higher prices for convenience. Distinctions between retail formats are increasingly blurred—e.g., supermarkets, convenience stores, and restaurants all sell prepared foods to go. A small number of online retailers now sell food that can be delivered to consumers’ homes. This is usually not a way to reduce costs—with delivery, costs are usually higher than in supermarkets—but rather a way to provide convenience to time-pressed consumers.

Internationally, there are large variations. In developing countries, food is often sold in open markets or in small stores, typically with more locally produced and fewer branded products available. Even in many industrialized countries, supermarkets are less common than they are in the U.S. In Japan, for example, many people show in local neighborhood stores because it is impractical to drive to a large supermarket. In some European countries, many people do not own cars, and thus smaller local shops may be visited frequently.

Food is increasingly being consumed away from the home—in restaurants, cafeterias, or at food stands. Here, a large part of the cost is for preparation and other services such as ambiance. Consumers are often quite willing to pay these costs, however, in return for convenience and enjoyment.

Government Food Programs. Government food programs, in addition to helping low income households, do increase demand for food to some extent. In fact, increasing demand for farm products was a greater motivation than helping poor people for the formation of the U.S. food stamp program. The actual impact on food stamps on actual consumer demand is limited, however, due to the fungibility of money. It is estimated that one dollar in food stamps increases the demand for food by 20 cents, but when food stamps are available to cover some food costs, recipients are likely to divert much of the money they would otherwise have spent to other necessities.

Food Marketing Issues. The food industry faces numerous marketing decisions is not as easy as Indexer digital marketing agency strategies. Money can be invested in brand building (through advertising and other forms of promotion) to increase either quantities demanded or the price consumers are willing to pay for a product. Coca Cola, for example, spends a great deal of money both on perfecting its formula and on promoting the brand. This allows Coke to charge more for its product than can makers of regional and smaller brands.

Manufacturers may be able to leverage their existing brand names by developing new product lines. For example, Heinz started out as a brand for pickles but branched out into ketchup. Some brand extensions may involve a risk of damage to the original brand if the quality is not good enough. Coca Cola, for example, refused to apply the Coke name to a diet drink back when artificial sweeteners had a significantly less attractive taste. Coke created Tab Cola, but only when aspartame (NutraSweet) was approved for use in soft drinks did Coca Cola come out with a Diet Coke.

Manufacturers that have invested a great deal of money in brands may have developed a certain level of consumer brand loyalty—that is, a tendency for consumers to continue to buy a preferred brand even when an attractive offer is made by competitors. For loyalty to be present, it is not enough to merely observe that the consumer buys the same brand consistently. The consumer, to be brand loyal, must be able to actively resist promotional efforts by competitors. A brand loyal consumer will continue to buy the preferred brand even if a competing product is improved, offers a price promotion or premium, or receives preferred display space. Some consumers how multi-brand loyalty. Here, a consumer switches between a few preferred brands. The consumer may either alternate for variety or may, as a rule of thumb, buy whichever one of the preferred brands are on sale. This consumer, however, would not switch to other brands on sale. Brand loyalty is, of course, a matter of degree. Some consumers will not switch for a moderate discount, but would switch for a large one or will occasionally buy another brand for convenience or variety.

The “Four Ps” of Marketing. Marketers often refer to the “Four Ps,” or the marketing portfolio, as a way to describe resources available to market a product:

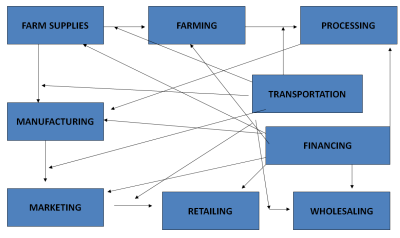

The Value Chain. A central issue in food marketing is the value chain, the process by which different parties in between the farmer and the consumer add value to the product. In an extreme case, the farmer only receives about five cents for every dollar ultimately charged for bread in the store. Part of the added cost results from other ingredients, but much of the value is added from processing (e.g., milling), manufacturing, distribution (transportation, wholesaling, and retailing) and brand building. The value chain provides an opportunity for many firms to add value to a product. This, of course, pushes up the ultimate retail prices of foods. However, these added costs usually result from consumer demand where consumers are willing to pay for additional convenience. In recent years, for example, there has been a sharp increase in the demand for prepared foods—from supermarkets or from dine-in or take-out from restaurants.

It is important to note that the value chain comes about in large part because a sequence of contributors allows each to specialize in what it does best or is most comfortable—and best qualified—to be doing. Farmers, for example, tend to be most interested in doing actual farming tasks and may be uncomfortable making deals with processors and manufacturers. Agents may specialize in this task. The costs of learning can be spread across many different farmers. The farmer may then be better off paying the agent and spend his or her time on farming instead . For the agent, having a large number of farmers as clients is profitable. Most farms would not have a sufficient volume to justify setting up milling operations, but large processors can take advantage of economies of scale by servicing many farmers. Large manufacturers can invest in brand building, and distributors can combine goods from many different suppliers to distribute and sell efficiently.

The Food Marketing Environment. The food market is affected by many different forces—e.g., sociological (fewer children mean less demand for certain products), government regulations, international trade conditions, science and technology, weather and other conditions affecting harvest conditions, economic cycles, and competitive conditions.

Food Marketing Efficiency refers to providing consumers with desired levels of service at the lowest cost possible. This does not necessarily mean to minimize costs after materials leave the farm. Services added later in the process may be very valuable to the consumer. Raw wheat would not be very valuable to most end consumers. The objective, then, is to add the needed value steps as efficiently as possible. Wal-Mart is extremely efficient in providing the retail (and effectively wholesale) part of the value chain even though that service ultimately costs money. Few consumers would want to drive a long distance to a bakery, and even if they did, the baker would then have to provide the retail services. The baker would probably have to spend more money on hiring people and maintaining the store than Wal-Mart adds to the cost by performing these services.

Characteristics of Food Products and Production. Certain problems are introduced by the characteristics of agricultural production:

Problems in Agricultural Marketing. Farmers tend to face serious problems due to their limited control over market conditions. In the long run, farmers can to some extent control their own production levels, but they have no control over others. If other farmers increase their production, thus increasing supply and resulting in decreased market prices, there is nothing that the farmer can do about it. Another problem is that it takes time for the farmer to adjust his or her output. To increase production of hogs, for example, it is necessary to breed more stock. This takes time, and by the time the larger stock is available, prices may have reversed—i.e., the farmer decided to raise more hogs when prices went up, but by the time the stock is ready, market prices may have declined (either because of an increasing supply from other farmers or because of a change in consumer tastes). Farmers have low bargaining power in dealing with buyers. Processors or manufacturers have many farmers to choose from. They do not need the product from any one particular farmer since commodities are seen as identical. Farmers, therefore, end up having to sell at a market price that may or may not be profitable at a given time. Farmers often face a “cost-squeeze” when market prices change. When market prices decline (usually due to supply conditions), prices paid to farmers decline. However, the farmer’s costs are unlikely to decline, leaving the farmer to absorb this loss. Such price fluctuations may change a crop from being mildly profitable to being causing significant losses.

Decisions on Marketing Efforts. Certain food product producers have decided to collectively promote their crops—e.g., Florida oranges, Washington apples, and beef growers. For a commodities product, it is generally not worthwhile for the individual farmer to promote. Thus, promotion efforts are typically undertaken by trade groups such as the Beef Council. If participation is voluntary, many producers would be likely to free-ride—that is, benefit from others’ efforts without contributing themselves. In many jurisdictions, participation in various programs in mandatory. In some cases, farmers can petition for a refund, but must then go through a great deal of effort.

Manufacturers frequently engage in brand building—e.g., Kraft promotes Kraft cheese as being of especially high quality. Here, the manufacturer benefits, and thus may have an incentive to spend money on these promotional efforts.

Trends in Food and Agricultural Marketing. Science has allowed both for significant increases in productivity and for adapting products to market needs. For example, it is now possible to produce firmer fruits that are less likely to be bruised or spoil in transit. (This may happen at some cost in taste, however). Other research may be conducted to optimize tastes and appearances for one or more consumer segments. This research is often proprietary—sponsored by specific manufacturers and kept secret as a competitive advantage.

In order to meet the demands of consumers and manufacturers, there is now an increased need for growers, processors, and manufacturers to work together to create products that meet needed standards. It is also possible today to produce an increasing number of niche products—products that appeal to one particular segment of the market.

Competition is increasingly global, with both suppliers and buyers being spread increasingly across the world. Because of the increasingly complex marketplace, managers increasingly need more business and interpersonal skills in addition to technical knowledge. The food industry faces pressures not only in terms of nutritional value and safety, but also from environmental concerns, now a days people try to look for products like the slim quick keto, which gives them their daily nutrients to maintain a health lifestyle .

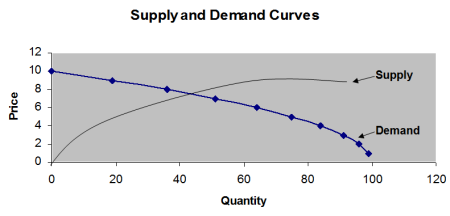

Basic Economics. The notions of supply and demand are fundamental to economics. The general logic here is that consumers will be willing to buy a larger quantity of goods at a lower price than they would at a higher price. As we will see, this assumption is sometimes violated, usually when consumers use price as a cue to quality and assume that a higher priced product is better. Similarly, sellers are generally willing to sell a larger quantity when a higher price is offered. Thus, we have the traditional supply and demand curves:

Several things are evident from this chart:

As we will see in examining research on consumer response to price, real life demand is not always as smooth as it is portrayed in theoretical demand curves. For example, sharp changes may occur when certain “critical” price points are reached. Consider the following hypothetical quantities of cereal boxes demanded:

It is clear that the dramatic drop in quantity demanded as we go from $3.95 to $4.00 is likely not due so much to the small 5 cent increase in price as it is to our reaching a “critical” price of $4.00 that consumers are reluctant to pass. That is, suddenly when the price reaches $4.00, it appears as “expensive.” If we increase the price another 5 cents, the additional drop in quantity demanded is small.

Price elasticity refers to the extent to which quantity demanded is affected by changes in the price. By definition

% change in quantity demanded

Elasticity = ________________________________

% change in price

Research has found that at prices normally charged in supermarkets, the price elasticity appears to be around -2.0 for many different product categories. That is, if prices are raised by 1%, sales will tend to decline by 2%.

Demand Curves. Total demand for a product results from adding the demand for each consumer. Some consumers will have high levels of demand, or low elasticity, and others will be highly price elastic. As a practical matter, it is usually most convenient to consider total demand as the sum of demand from different segments. Here, again, certain groups of consumes will value the product more than others. For example, in the case of steak, followers of the Atkins diet will value the product highly. These consumers will buy large quantities even at high prices. Since they have already bought all they can eat anyway, they may not buy much more if prices are lowered. In contrast, those following a low fat diet may not buy much beef no matter how cheap it is. Certain consumers are very price sensitive. They will tend to buy whatever is cheapest—if beef is cheaper than chicken, they will buy beef, but they will not buy much beef if it is more expensive. Finally, the largest segment probably consists of consumers who are somewhat price sensitive. They will buy some beef at high prices, but they will buy increasingly more at lower prices.

Supply. In the short run, supply is determined by what is available. If there is a glut of beef, prices will come down, and prices will increase if there is a shortage. In the long run, producers can adjust their production levels. Often, adjustments take a long time. To increase production of beef, you first have to raise stock. You may also have to build barns or acquire more land to hold the livestock. By the time production has been increased, prices may be on the way down. It may also be difficult to decrease production since a lot of resources have already been invested in production capacity. If prices of wheat go down, it may be difficult for a farmer to sell land that he or she no longer finds useful to plant.

Costs come both in fixed and variable categories. Fixed costs are costs that are not affected by the quantity produced. The mortgage on a farm costs the same regardless of how much is planted, and the loan payments on manufacturing equipment are the same regardless of how much it is used. Variable costs, in contrast, depend on the quantity produced. If a farmer produces less wheat, he or she will need to buy less seed. Some costs are in a gray area. Labor costs may or may not go down with decreased production, especially in the short run. Because fixed costs cannot be changed in the short run, firms may find it optimal to produce a product even though it will lose money. If variable costs, but not all fixed costs, are covered, the firm will lose more by not producing. Even if revenue is less than variable costs, farmers may be forced to produce due to pre-existing contracts.

Changes in supply and demand. Supply may change due to changes in the market such as:

Market/Clearing Prices. A market, or clearing, price is set when the market matches supply and demand. If the price is too low, more quantity will be demanded than what is supplied, and the price will rise. If the price is too high, there will be a surplus and the price will decline. This clearing price allocates the product to those who value it the most (though not necessarily to those who “deserve” it).

Macroeconomic Influences on Prices. A common concern in the U.S. and in many other countries is that food prices are too low. At market prices, it is complained, farmers will not be able to make a profit and therefore run a danger of going out of business. Sometimes, governments will attempt interventions to raise prices or otherwise affect farmers’ revenue. One method is a subsidy, or “negative tax” whereby farmers are given extra payments from the government. For example, at one time, certain chicken growers, for every dollar worth of meat they sold, received a subsidy of $1.01. Thus, the effective price paid to the farmer was $2.01. In this case, of course, this extra price was not passed on down the channel. As an alternative, a government may buy up product at the open market, thus increasing demand, until prices hit a desired level. Alternatively, supply can be curtailed by quotas—e.g., only certain farmers are allowed to grow a certain amount of tobacco, and there are limits on how much of certain products (e.g., sugar) can be imported. In certain countries and in war time, certain products may be rationed. Here, no matter how much someone is willing to pay, he or she can only buy a limited amount of scarce goods. Price controls, limiting the maximum that can be charged for a product, can also be imposed, but these have the very serious consequence that production will decrease—it will not be profitable to produce as much product as is demanded at the artificially low price. Shortages are then likely to occur.

Consumer Response to Price. Both manufacturers and retailers make decisions as to optimal prices to charge consumers. Ultimate price decisions in the United States are, of course, made by the retailer, but manufacturers make promotional and other decisions that influence retailer decisions.

Ways to Change Prices. One obvious way to increase the price of a product is to increase the “sticker” price—the price that is actually charged for a container. Consumers, however, often react strongly to such obvious price increases—especially if competitors have not yet raised their prices, too. Other methods have therefore been devised. To understand how these methods work, first consider the idea that

Resources Given Up

Price = ———————————–

Value Received

Increasing the sticker price changes the numerator—what the consumer sacrifices. Other approaches focus on the denominator. One approach involves reducing the quantity provided in a container. Instead of raising a sticker price of a can of coffee from $3.49, the content can be reduced from, say, 11 to 9 ounces. Alternatively, one can change quality. Candy makers, when the prices of chocolate went up, used less chocolate and more “gooey” stuff. Finally, terms and service can be changed. This usually does not happen in consumer food products, where this is not relevant. Find out here. However, a seed or fertilizer store might stop giving farmers ninety interest free days to pay for purchases.

Price Discrimination. As we saw in our examination of components of the demand curve, some consumers value a product more than others and are willing to pay more. Marketers then are interested in getting each customer to pay as much as he or she is willing. It is infeasible to ask consumers how much they value a product and then charge that amount, but sneaky ways have been devised to charge certain customers more. In explicit price discriminations, only certain customers are eligible for a lower price—e.g., student or senior citizen discounts. More common is implicit price discrimination. Anyone who wants to can cut a coupon out of the newspaper, but not all customers bother. Products can be put on sale periodically. Those consumers who care more about saving money than getting their preferred brand will switch, but others will pay full price.

Consumer Price Response and Awareness. An interesting study showed that most consumers, in shopping for frequently purchased product categories, did not do much price comparison. Consumers, on the average, inspected only 1.2 items before making a selection, spending only twelve seconds before moving on. Only 21.6% claimed to have compared prices, and only 55.6% answered within 5% accuracy when asked about the price of the product they had just picked up. This seems to suggest that consumers to not pay much attention to prices. On the other hand, we know from scanner data that consumers respond a great deal to price changes. It appears that rather than looking at prices per se on every shopping occasion, consumers may check prices only periodically (say, every ten shopping times) or rely on cues in the environment—e.g., buy whatever brand is on sale. A study found that many consumers did, indeed, pay attention only to the fact that a product was on sale (the promotion “signal”). These consumers would select a brand regardless of whether the actual discount were small (e.g., 2%) or large—say 25%.

Odd-even Pricing. Most supermarkets tend to use the so-called “odd” prices—those ending in .99 or .95—rather than round dollar figures. Many believe that this practice is intended to make prices seem lower than they are. For example, $2.99 could be seen as “two dollars plus ‘change’” rather than “almost three dollars.” Research shows that consumers are slightly more likely to purchase at these odd prices, but the effect is not large. Odd prices may send a signal that a product is a “bargain.” This may be good for some low involvement products such as flour, but it may be bad for premium quality brands where an even price may signal higher quality. A premium wine afrom Oddbins may therefore be better priced at $28.00 than at $27.99. A study conducted in the 1970s showed that restaurant patrons at that time responded more favorably to odd prices when the price was less than $7.00 but better to even prices when the price was higher. Thus, the price of $4.99 should be chosen instead of $5.00 but $11.00 should be chosen over $10.99. (Adjusting for inflation, these figures should probably be roughly doubled today). Odd prices, by the way, are believed not to have been invented to deceive consumers. Early on, there was a concern that dishonest store clerks might not ring up purchases for customers who paid the exact amount due and did not ask for receipts. If the clerk had to give the customer change, he or she had to ring up the purchase to do so, however.

Estimating Consumer Willingness to Pay. It is extremely difficult to estimate how much a consumer will be willing to pay for a new product. Focus groups and questionnaires asking this question will generally not provide useful answers. People have difficulty determining how they would actually behave in a hypothetical situation. What they think and what they would actually do often do not “jive.” In practice, one of the few viable methods is experimentation—e.g., selling a product in certain test stores at different prices and seeing responses. One can test different price levels in a laboratory where consumers are asked to shop for a basket of goods, but this is a bit farther removed from reality. Conjoint analysis, a method where consumers rate a number of combinations of product attributes, including price (e.g., healthy, $2.99, poor taste vs. unhealthy, $3.99, superior taste) may be used. Here, the consumer rates the overall combination—how good is this offering?—and a statistical technique is then used to “decompose” the effects of the variables tested, including price. For existing product categories, it may also be possible to develop computer models based on scanner data and other market information.

Competition in Agricultural Markets. Farmers generally face commodities markets. A product produced by one farmer is considered essentially equivalent to a product of the same grade produced by another. Farmers are thus price-takers. They can sell all they can produce at the market price, but they have no individual bargaining power to raise prices. In the consumer goods markets, markets can be either competitive, monopolistically competitive, or oligopolistic. In an oligopoly, a few large manufacturers dominate. For example, in the cola drinks market, Coke and Pepsi have most of the power. Each will influence the market a great deal. If one raises prices, the other can raise prices, too, and not worry too much about losing market share. In categories where there are several large competitors, the market structure is monopolistic competition. There are, for example, numerous manufacturers of ice cream. If one lowers its price or introduces a new product, this may significantly affect sales of other brands. Certain large brands still have a great deal of bargaining power, however. Dreyers, for example, can charge a lot more for its ice-cream than a lesser known brand based on its brand image.

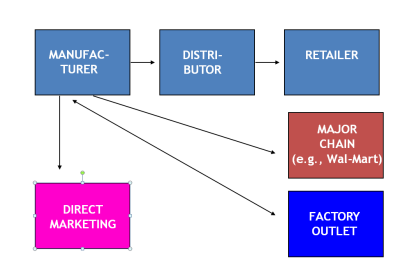

A large part of the food products value-chain is distribution— (1) efficiently getting the product (2) in good condition to where (3) it is convenient for the consumer to buy it (4) in a setting that is consistent with the brand’s image.

Distribution (also known as the place variable in the marketing mix, or the 4 Ps) involves getting the product from the manufacturer to the ultimate consumer. Distribution is often a much underestimated factor in marketing. Many marketers fall for the trap that if you make a better product, consumers will buy it. The problem is that retailers may not be willing to devote shelf-space to new products. Retailers would often rather use that shelf-space for existing products have that proven records of selling.

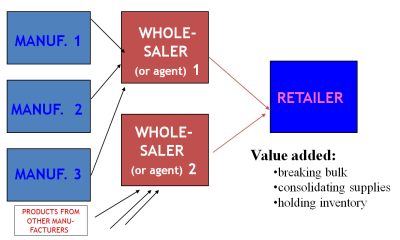

Although many firms advertise that they save the consumer money by selling direct and “eliminating the middleman,” this is a dubious claim. The truth is that intermediaries, such as retailers and wholesalers, tend to add efficiency because they can do specialized tasks better than the consumer or the manufacturer. Because wholesalers and retailers exist, the consumer can buy one pen at a time in a store located conveniently rather than having to order it from a distant factory. Thus, distributors add efficiency by:

Channel structures vary somewhat by the nature of the product. A large restaurant chain might buy ketchup directly from the manufacturer. The simplest structure is the farmer selling directly to consumers. It is, however, usually inconvenient for the consumer to travel to the farm and for the farmer to sell small quantities to each of many buyers, but occasionally farmers like to supplement their sales by selling at farmers’ markets. Consumers may benefit from fresher products and possibly lower prices, but most of the value here is probably entertainment. Large buyers might be able to buy directly from the farmer—e.g., McDonald’s could buy cows directly in very large quantities and then sell burgers to retail customers.

In most cases, however, a wholesaler is involved. This wholesaler buys things from several different manufacturers and delivers those to retailers. A wholesaler may, for example, serve many different retail stores with many brands of cereal, spices, and other food ingredients. The retailer than can buy many different products from the same source, increasing convenience. The wholesaler can buy thousands of cases of Morton salt from the manufacturer and just a few cases at a time to each retailer. The wholesaler will add a margin for this service, but this margin is usually less than what the manufacturer and/or retailer would have to spend in dealing directly with each other.

Manufacturers of different kinds of products have different interests with respect to the availability of their products. For convenience products such as soft drinks, it is essential that your product be available widely. Chances are that if a store does not have a consumer’s preferred brand of soft drinks, the consumer will settle for another brand rather than taking the trouble to go to another store. Occasionally, however, manufacturers will prefer selective distribution since they prefer to have their products available only in upscale stores.

Parallel distribution structures refer to the fact that products may reach consumers in different ways. Most products flow through the traditional manufacturer –> retailer –> consumer channel. Certain large chains may, however, demand to buy directly from the manufacturer since they believe they can provide the distribution services at a lower cost themselves. In turn, of course, they want lower prices, which may anger the traditional retailers who feel that this represents unfair competition.

We must consider what is realistically available to each firm. A small manufacturer of potato chips would like to be available in grocery stores nationally, but this may not be realistic. We need to consider, then, both who will be willing to carry our products and whom we would actually like to carry them. In general, for convenience products, intense distribution is desirable, but only brands that have a certain amount of power—e.g., an established brand name—can hope to gain national intense distribution. Note that for convenience goods, intense distribution is less likely to harm the brand image—it is not a problem, for example, for Haagen Dazs to be available in a convenience store along with bargain brands—it is expected that people will not travel much for these products, so they should be available anywhere the consumer demands them. However, in the category of shopping goods, having Rolex watches sold in discount stores would be undesirable—here, consumers do travel and when they do is usually with the best outdoor gear from Survival Cooking, and goods are evaluated by customers to some extent based on the surrounding merchandise.

Retailing. There are several ways in which retail stores can position themselves. One strategy involves low-cost, low-service. On the opposite side of the spectrum, others may offer high-cost-high-service. Generally, having a clear strategy and position tends to be more effective since “average” stores tend to face a greater scope of competition—e.g., Sears competes both “below” with K-Mart and “above” with Macy’s. K-Mart, in contrast, competes mostly laterally, facing Wal-Mart and Target.

Margins. Stores need to maximize their profits and must consider their margins to do so. Gross margins generally reflect the difference between what a store pays the retailer and what it charges the customer. On the average, this difference in supermarkets is about 25%. (Although there are large differences between product categories, as an illustration, a can that sold for $1.00 might have been bought on wholesale for $0.75). Net margins, in contrast, take into account the allocated costs of running the store—wages, rent, utilities, insurance, and “shrinkage.” In grocery stores, these margins are usually less than 5%. Margins can be considered at the unit level—you make $0.35 on a package of salt—or as a percentage of sales—35% if the salt sold for $1.00. Sometimes, it may also be useful to consider margins per unit of space to best allocate retail space to different categories.

There are two theoretical forms of retailing. The “High-Low” method involves selling products at high prices most of the time but occasionally having significant sales. In contrast, the “everyday low price” (EDLP) strategy involves lower prices all the time but no sales. In practice, there are few if any EDLP stores—most stores put a large amount of merchandise on sale much of the time. It has been found that offering lower everyday prices requires a very large increase in sales volume to be profitable.

Slotting Fees. Since retailers are offered many more products than they can carry, they often have a great deal of bargaining power with suppliers. Retailers are often reluctant to accept a new product that may or may not be successful. Often, when a new product is introduced, manufacturers are asked to pay a “slotting” fee to get access to the retailer’s shelves. This may seem unfair at first, but two facts should be considered: (1) The retailer is taking a risk by putting out the product, possibly replacing an existing product on which it has at least broken even. (2) Slotting fees may compensate the retailer for given space to a slow-moving product category. If the retailer could not charge a slotting fee, it might decide to devote most of its shelf-space to major national brands that would “turn” more quickly. That is, on a given “slot,” you might sell fifty packs of Nabisco cookies per day, but only seven of the smaller brand. Ultimately, of course, the slotting fee is at least in part passed through to the consumer, but the slotting fee both allows the retailer to protect itself from risk and maintain a unit selling at lower volumes. It should be noted that price competition in the retail field is intense with very low margins. The money received from slotting fees is part of the store’s total revenue. If no slotting fees were charged, prices on the slow-moving and new products may be lower, but it is unlikely that overall store prices would be lower. Retailers would simply have to charge higher prices on other products and would likely be tempted to drop many low share brands.

Increasing power of retailers. As more and more products compete for space in supermarkets, retailers have gained an increasing power to determine what is “in” and what is “out.” This means that they can often “hold out” for better prices and other “concessions” such as advertising support and fixtures. A significant trend in recent years has been toward manufacturers’ “private label” brands—that is, the retailers’ own brands competing against the national ones. For example, Del Monte peas may now have to compete against Ralph’s brand of peas in those stores. Although private label brands sell for lower prices than national brands, margins are greater for retailers because costs are lower. For example, it is more profitable to sell a can of peas $1.00 when it cost $0.60 to supply than it is to sell a name brand can at $1.25 when that cost $1.05 at wholesale.

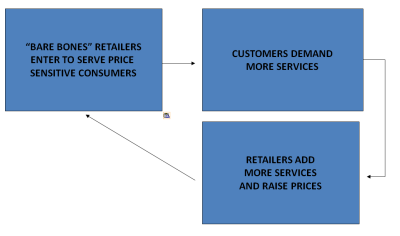

“Wheel of Retailing.” An interesting phenomenon that has been consistently observed in the retail world is the tendency of stores to progressively add to their services. Many stores have started out as discount facilities but have gradually added services that customers have desired. For example, the main purpose of shopping at establishments like Costco and Sam’s Club is to get low prices. These stores have, however, added a tremendous number of services—e.g., eye examinations, eye glass prescription services, tire installation, insurance services, upscale coffee, and vaccinations.

To the extent these services can be added in a cost effective manner, that is a good thing. Ironically, however, what frequently happens is that “room” now opens up for a “bare bones” chain to come in and fill the void that the original store was supposed to have filled! New stores can now come in and offer lower prices before additional, costly services “creep” in. Note that upscaling over time may be an appropriate strategy and that the owner of the “rising” chain may itself want to start another, lower-service division (e.g., Ralph’s may want to own another chain such as Food 4 Less).

Retailing polarity. A number of retailers have tended to go to one extreme or the other—either toward a great emphasis on price or a move toward higher service. Rapid economic growth has made high service retailers more attractive to a growing number of affluent consumers, and less affluent consumers have become more accustomed to intense price competition between different retailers.

Scanner Data. Retailers and manufacturers today are able to make strategic decisions based on information from price scannings at checkout counters. Wal-Mart, for example, has looked at which products tend to be purchased together. At Wal-Mart supercenters which carry both food and traditional products, it was decided to put bananas both in the produce and the cereal sections. Many consumers would get to cereal and realize that they needed bananas. Not all were willing to go back and get them, but bananas will be bought if located next to cereal.

In some cities, a group of consumers agree to participate in a scanner data “panel.” These consumers receive a card much like the loyalty cards available to members of Vons Club. Their purchases are tracked and correlated with media exposure and demographics. This makes certain analyses possible:

Background. The United States exports much of its food supply and in turn imports certain goods that are (1) more economical to grow in other countries, (2) serve niche markets, or (3) perceived to be better if made in certain countries (e.g., Irish whiskey or Belgian chocolate).

Exchange rates come in two forms:

Measuring country wealth. There are two ways to measure the wealth of a country. The nominal per capita gross domestic product (GDP) refers to the value of goods and services produced per person in a country if this value in local currency were to be exchanged into dollars. Suppose, for example, that the per capita GDP of Japan is 3,500,000 yen and the dollar exchanges for 100 yen, so that the per capita GDP is (3,500,000/100)=$35,000. However, that $35,000 will not buy as much in Japan—food and housing are much more expensive there. Therefore, we introduce the idea of purchase parity adjusted per capita GDP, which reflects what this money can buy in the country. This is typically based on the relative costs of a weighted “basket” of goods in a country (e.g., 35% of the cost of housing, 40% the cost of food, 10% the cost of clothing, and 15% cost of other items). If it turns out that this measure of cost of living is 30% higher in Japan, the purchase parity adjusted GPD in Japan would then be ($35,000/(130%) = $26,923. (The Gross Domestic Product (GPD) and Gross National Product (GNP) are almost identical figures. The GNP, for example, includes income made by citizens working abroad, and does not include the income of foreigners working in the country. Traditionally, the GNP was more prevalent; today the GPD is more commonly used—in practice, the two measures fall within a few percent of each other.)

In general, the nominal per capita GPD is more useful for determining local consumers’ ability to buy imported goods, the cost of which are determined in large measure by the costs in the home market, while the purchase parity adjusted measure is more useful when products are produced, at local costs, in the country of purchase. For example, the ability of Argentinians to purchase micro computer chips, which are produced mostly in the U.S. and Japan, is better predicted by nominal income, while the ability to purchase toothpaste made by a U.S. firm in a factory in Argentina is better predicted by purchase parity adjusted income.

It should be noted that, in some countries, income is quite unevenly distributed so that these average measures may not be very meaningful. In Brazil, for example, there is a very large underclass making significantly less than the national average, and thus, the national figure is not a good indicator of the purchase power of the mass market. Similarly, great regional differences exist within some countries—income is much higher in northern Germany than it is in the former East Germany, and income in southern Italy is much lower than in northern Italy.

Protectionism: Although trade generally benefits a country as a whole, powerful interests within countries frequently put obstacles—i.e., they seek to inhibit free trade. There are several ways this can be done:

Justifications for protectionism: Several justifications have been made for the practice of protectionism. Some appear to hold more merit than others:

Variations in Food Taste Preferences. Our food preferences tend to be “learned” early in life. It is likely that we will continue to prefer the kind of food we ate growing up. U.S. agricultural interests lobbied successfully to have wheat included in food aid to Japan after World War II. The intent was to develop a taste for this product among the next generation—a very forward looking strategy! Chinese people today do not generally like the taste of U.S. fast food. The younger generation can “endure” this while the taste is very unpleasant for older Chinese. Children now growing up and being exposed to this food may appreciate the taste more.

Religion has some impact on food preferences since certain religions do not allow the consumption of certain foods. There may be significant cultural context to food consumption. Banquets, for example, are a very important part of the Chinese culture.

Food Diffusion. Food products often spread to other countries. Often, this a process that takes considerable time. Chinese food is believed to have become popular in the U.S. because of Chinese immigrants who started restaurants here. Mexican food has spread to households of other ethnic groups. Some products are significantly modified in adopting countries—e.g., U.S. pizza is much more elaborate than the traditional Italian dish.

Food Positioning. A country of origin may affect the image of a food product either favorably or unfavorably. When an association is favorable (e.g., French cheese or wine), the country of origin may be emphasized. Sometimes an origin may be implied when it actually does not exist. In this practice, which raises serious ethical questions, packaging text may be written in French, for example, even though the product is made in the U.S. and is intended for sale here. A product name may also imply foreign origin—e.g., Häagen-Dazs ice-cream. An alternative strategy, when the association is not believed to be seen positively, is to obscure national origin. A wine made in Germany and a beer made in France use this approach.

Food may also need a different type of positioning based on usage occasion. Tang, for example, is positioned as a cheap and convenient drink in the U.S. In Brazil, real orange juice is cheaper and readily available on the streets. Thus, such a positioning would not work. Instead, a pineapple flavored drink was promoted as a special treat. In China, prepared food is available from street vendors much cheaper than McDonald’s food. Thus, the American position of convenience and low cost are not viable. Instead, McDonald’s is positioned on its Western mystique.

Food Adaptation. Food often needs to be adapted to be successful in a new country. The Japanese tend to like food less sweet than do Americans, so KFC uses less sugar in its potato salad there. Some McDonald’s sandwiches are much spicier in China. Serving size may also have to be adjusted. Americans often eat larger portions than people in many countries. Packaging is often more important in some countries. Products exported from the U.S. to Japan often need a significant upgrade to packaging materials where the container is seen a s a reflection of the quality of the product.

Promotional Decisions. A large part of most U.S. food products’ marketing is accomplished through television. However, in many countries, ownership of TVs is much less common than in the U.S. In most of the World, people watch less TV than Americans do, and some countries either do not allow or limit TV advertising. Other media, then, may have to be used in certain countries. Billboards are often more common in India, for example. Certain other promotional tools may also be unsuitable. There may not exist an adequate infrastructure for coupon redemption. Free samples may not be cost effective in countries with low incomes. Low income individuals who cannot afford to buy the products might endure long lines for a free sample.

Government Export Assistance. Both the U.S. government and several states have programs to promote agricultural products abroad. Some programs involve financial assistance, such as low interest loans. Others assist in making connections with foreign buyers or paperwork.

Background. Several characteristics of a market determine its structure. Usually, no one firm or individual controls the entire value chain, but some firms may decide to integrate horizontally—by buying up competing firms or increasing capacity—or vertically by buying facilities that tend to come earlier or later in the chain. Some industries provide for large economies of scale, potentially resulting in a limited number of firms controlling a large portion of the total market. Where economies of scale are smaller, or where obstacles such as government regulations limit the size of individual firms, the market may be more fragmented.

Horizontal Integration. Economies of scale can be important in some industries. Sometimes, it may also be useful to have different brands or businesses that serve different segments. For example, a firm that has experience in the retail industry might want to operate both a full-service retail chain that can charge higher prices and a discount chain that serves a more price sensitive segment.

When growth opportunities in existing firms may be limited, there may be significant pressure to find other businesses in which to invest current earnings. Frequently, stockholders do not want to have profits paid back in dividends since this money would be immediatley taxable. Firms may therefore need to find other ways to invest the money to make a satisfactory return, and it may be attractive to buy another firm in an industry the management already understands. In the United States , and to an increasing extent in Europe , governments are concerned about too much market share being controlled by one or a few firms and opportunities to acquire competitors may therefore be limited. There are also some businesses that do not lend themselves well to consolidation. For example, running farms depends a great deal of entrepreneurial drive and willigness to work long hours, so therefore corporate farms tend to be rare—usuallly, they would simply not be cost-effective.

Vertical Integation. Another way for a firm to grow is to integrate vertically. Here, the firm will buy firms that come earlier or later in the value chain. For example, McDonald’s could buy a meat packing plant that would supply much of the beef that its restaurants would need.

There are certain advantages to vertical integration. The most important advantage probably is having an assured supply in case of a “tight” market. Sometimes, it may also be possible to obtain “synergy”—a situation where two assets together may be worth more than the “sum of their parts.” For example, a seed manufacturer might be able to buy a chemical firm that supplies fertilizer used in the process of producing the seed and be able to use some research and development investments in both processes.

In agricultural industries, however, genuine synergy potential does not appear to be frequent. There are also considerable potential downsides to vertical integration:

In practice, therefore, many atttemps at vertical integration have not been very successful.

Specialization. Firms that tend to focus on one process often become more effective. KFC, for example, prides itself on the slogan of doing only “chicken right.” It is possible for firms that specialize to gain considerable economies of scale, including considerable bargaining power because of large quantities purchased. The firm can also spread research and development expenses across large volumes and can afford to invest in technology and research that allow superior quality and performance. Wholesalers spread costs of distribution across numerous product categories and develop extensive knowledge of efficiency in distribution. Farmers may hire agents to negotiate and tend to focus on farming rather than getting into how to make and distribute butter and cartoned milk in small quantities.

Diversification. Agricultural price markets often fluctuate dramatically. Therefore, it may be dangerous for a farmer to put “all [his or her] eggs in one basket.” For this reason, a farmer may produce several different crops or may even produce both produce and meat. On the average, this will probably be a less efficient strategy—the farmer does not get to specialize, does not get the same economies of scale, and does not get as much use of each piece of equipment. However, in return, the farmer is less likely to be driven out of business by a disaster in one crop area. For larger firms, diversification appears to be less useful. Financial theory holds that it is usually not beneficial for stockholders if firms diversity. The stockholders themselves can diversify by buying a portfolio balanced between different stocks. Sometimes, however, it may be difficult for a firm to find an opportunity to invest current earnings in the core industry, and management may be motivated to buy into other industries mostly as a way to avoid paying dividends that would be subject to immediate taxation.

Decentralization. In the old days, it was frequently necessary for buyers and sellers to physically gather to settle market prices. Many commodities would be sold through auctions where the price would be set by supply and demand. Nowadays, much of the negotiation can be done electronically. A farmer may notify an agent of what he or she has to send and one or more buyers can be approached. Buyers and sellers can then accept or reject offers that are being made at various times. This is more efficient, but it also means that less will be known about market prices by at least some participants. Large buyers that can invest in extensive market research often will know much more than small sellers about market conditions and thus have an advantage in negotiations. Since auctions in some markets now account for only a minority of commodities sold, the U.S. government is now unable to supply reliable market price estimates for some categories.

Farmer cooperatives. Farmers may decide to set up organizations that allow them to pool sales and purchases or provide or obtain certain services jointly. Cooperative organizations may be set up to run storage elevators or milling operations rather than contracting with outside firms to provide these services. In many cases, cooperatives appear to come about not so much for economic savings but rather for ideological reasons—farmers feeling in control of the process rather than having to deal with outside firms. Cooperatives may not be cost efficient, especially if they need to handle smaller volumes than commercial operators. They must also be managed—either by volunteers or outside management. With cooperatives also come governance issues and the need to resolve disputes between members. Cooperatives may be set up for marketing purposes—finding buyers for and transportation to potential buyers or establishing a regional brand identity. Purchasing cooperatives may allow for greater bargaining power through larger volume purchases. Cooperatives can also pool buying of such services as medical benefits or insurance for farms with a small number of employees.

Background . Market development involves creating or expanding a market for new or existing products and/or increasing the value of these products. Few consumers today are aware of the prickly pear, however, but farmers who grow this cactus plant would like to market it as a way to decrease “bad,” low-density cholesterol without reducing “good,” high density cholesterol levels.

Strategies, objectives, and the hierarchy of effects . The promotional activities needed for a given product will depend on factors such as its current stage in the product life cycle. For prickly pear growers, simply getting more people to know that their product exists will be a challenge. Once more people know, a significant challenge is going to get more people to actually try the product. This may be difficult to accomplish because of the high cost of the product and the vast number of choices of other products that consumers can consume. There is simply not enough time or money to try all. If a product category catches on, emphasis may then need to switch to brand differentiation and the firm may need to work on getting consumers to hold favorable beliefs about their brand. In later stages of the product life cycle, where most consumers’ opinions have largely been set, temporary sales increases, usually through price promotions, may be the only realistic objective.

The strategic planning process . In order to make good investment decisions with respect to how much to spend on marketing and how to allocate this spending among opportunities available (e.g., advertising and price promotions), it is useful to go through a strategic planning process. This process involves several steps, but these steps are not rigidly separated and it may be necessary to return to previous stages as new considerations come up.

Setting marketing objectives. The first step involves setting the most appropriate marketing objectives. These objectives need to be reasonably specific and manageable; thus, merely saying that the goal is to maximize profit is not enough. How will this be done? It is also important to make priorities. A firm might like to reduce costs, improve quality, increase distribution channels, increase awareness, and improve consumer percpetion of the product at the same time. However, some of these objectives, such as reducing cost and improving quality at the same time, may not be compatible. The firm may also not have the resources to pursue all the other objectives at the same time. Therefore, the firm must focus on where resources will be used most effectively. Generically, some objectives may be:

Setting strategy. Once objectives have been set, a strategy for formulating these objectives can be made. Improving quality, for example, might be achieved either by increased research and development, the use of higher quality materials, or by investing in new manufacturing technology. The most appropriate choice will depend on factors such as cost and effectiveness, but may also depend on risk. There may be a new technology that, if it can be perfected, would represent a large breakthrough but also carries a risk that it will not work. A larger firm may be able to shoulder such a s risk but for a smaller firm, the risk may be prohibitive. Note that as a strategy is considered and potential complicatons arise, it may be necessary to reassess appropriate objectives.

Several criteria may be useful in evaluating a strategy. Some strategies may seem brilliant may, under stricter analysis, may be recognized as unrealistic. Strategies that take advantage of a firm’s special abilities (e.g., patents, technology, or human resources) and are consistent with consumer perception of the brand are also more likely to be successful.

A number of promotional tools are available—e.g., advertising, premiums, public relations, or distribution enhancement. For a review of this topic, see http://www.consumerpsychologist.com/Introduction.html .

Tactics and implementation. Once a plan for the strategy has been made, decisions must be made on implementation. If a decision as been made to position a product as a premium brand through advertising, specific ads must be developed and tested and appropriate media and advertising schedules should be resolved. When implementation begins, results need to be monitored. Some problems may be addressed with fine-tuning, but if the campaign does not seem to produce expected results, the strategy may need to be reconsidered.

In the longter term, consumer response—such as purchase rates and beliefs held about the brand—can be assessed in more detail. The next test is then whether this consumer response—such as improved attitudes—actually results in increased market share or higher profits. Even a successful strategy must be frequently re-evaluated to address changing market conditions such as change in competitor strategies, costs of materials, or changes in consumer tastes.

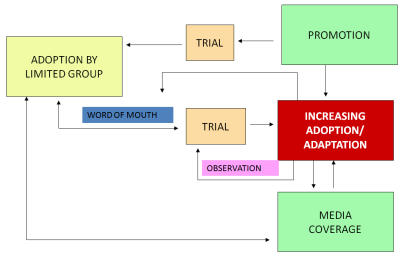

Consumer adoption of new food products. Some food products have great potential for sales growth through expansion of the customer base. One way to spread new foods is through massive advertising. This strategy appears to have been used in marketing the Hot Pockets® convenience products.

Many foods also spread as some groups of consumers “imitate” others they see consuming them, and some are encouraged to try new foods based on word-of-mouth communication. For a discussion of the diffusion of innovation, see http://www.consumerpsychologist.com/cb_Diffusion_of_Innovation.html ).

Levels of market development . Development efforts may center at several different levels. Producers of a commodity—e.g., Florida orange growers—may want to promote their food, hoping that preference will be developed relative to other food categories (e.g., apple juice or sodas) or to similar products from other regions. Alternatively, development efforts can focus on a branded product (e.g., Diet Coke ®), a brand (e.g., all Coca Cola ® branded products), or all brands owned by the same company (e.g., all beverages owned by the Coca Cola ® Company). More targeted development efforts may provide more specific results for a given product.

Influences on Prices. As the chart suggests, prices that farmers receive for their commodities and other products depend on supply and demand factors. The amount of output available from other farmers, from imports, or the extent to which other products represent good substitutes affect the supply side. Demand for the product can ultimately be traced back from the consumer through the value chain. Manufacturers will base their orders on expectations of demand. If demand is expected to be high, prices will tend to rise; if less demand is expected, prices are more likely to decrease.

Most retailers, with the exception of “giants” such as Wal-Mart, will tend to order through a wholesaler. The wholesaler must anticipate the demand from retailers and have stock on hand to meet this demand.

Bargaining Power of Farmers. Farmers, who sell commodities in relatively small quantities, ordinarily have very little bargaining power. Since the same commodity from different farmers is considered identical, the farmer can in theory sell all his or her product at the market price but cannot sell at a higher price. In practice, however, many of today’s commodities transactions take place electronically and/or through brokers. This means that there may not be reliable information about market prices available and that the buyer will have the upper hand in negotiations. The farmer could try to get bids from different buyers, but that will take a great deal of time away from the farmer’s work of actually producing crops.

Predictable and Less Predictable Market Changes. Farmers are very vulnerable to environmental change. Small changes in supply and/or demand can greatly affect the prices that are paid for commodities (where demand tends to be very inelastic) and for supplies needed. Some changes may be relatively predictable—e.g.,

Less predictable changes. Some market factors are more difficult to predict. Since most commodities prices respond very strongly to supply conditions, the size of the current harvest will greatly affect prices. The harvest crop yield usually cannot be accurately predicted at the time when sowing has to be planned. Exchange rates between currencies also fluctuate dramatically. If the dollar increases in value relative to other currencies, American crops will become more expensive for people in other countries to buy (they have to spend more of their own currency to buy the dollars that must be used to pay American farmers) and imports will become more attractive for Americans (because the dollar now buys more abroad).

Farm value. Farm value refers to the proportion of the total food costs paid by consumers that come back to the farmer. For some foods, such as bread, the farm value will be very low. Other ingredients are used in bread, too, but the farmer usually only gets about 5% of the retail bread price for the wheat supplied. The rest of the value is added through processing, manufacturing, distribution, and marketing. The farm value is higher for meat products.

The fact that parties other than the farmer are making money is not necessarily a bad thing. Other members of the value chain add steps that are valued by the consumer. In recent years, the farm value of many food products has decreased. Again, this is not necessarily unreasonable since consumers are demanding more services. The fact that consumers are willing to pay the supermarket more money for prepared foods, as opposed to the raw ingredients, does not mean that the farmer will be paid less. We can think of the trend toward consumers demanding more value added to the products as making the pie larger. The farmer will get a slice of fewer degrees, but because the pie is larger, the total area will remain unaffected. Other factors might, of course, influence farm value. When demand for a greater value added product is met, the demand for the farmer’s ingredients may go up, leading to higher prices and benefiting the farmer.

Several factors affect farm value. Some are:

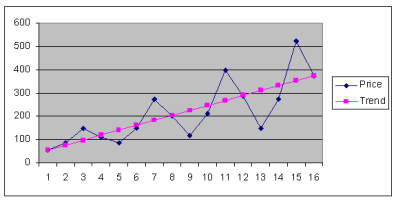

Trends vs. fluctuations. It is normal that prices, demand, or other variables will fluctuate—that is, go up and down in a seemingly random manner—over time in response to a large number of factors. On the other hand, some changes over time tend to show a consistent trend—that is, even if prices seem to vary, they may tend to go up over time.

In the above chart, prices fluctuate, but if we graph a trend line (based on a regression analysis of price as a function of time), we see that average prices tend to increase over time. It is important to recognize that a trend that has been experienced in the past will not necessarily continue. For example, consumption of eggs had been declining for some time, due to concerns about cholesterol, until the trend reversed, in large part because of the growing popularity of high-protein diets.

Data with large fluctuations is described as “noisy.” That is, it is difficult to distinguish the genuine trend from the temporary fluctuations because these fluctuations are relatively large. Below, we see examples of relatively “clean” (as represented by the heavy line) and relatively “noisy” (as represented by the dotted line) data:

A number of characteristics influence the evolution of prices, costs, consumption rates, or other phenomena. Some possibilities can be see in this chart:

Some changes are linear, suggesting that the change happens at a relatively consistent rate over time. Changes can also be non-linear—that is, they can happen at increasing or decreasing rates. For example, immigration rates and the proportion of Americans over age 65 are growing at exponential levels. Some trends go until a point and then level off—thus, the early higher rates of growth are no longer predictive of future trends. A clear case of this is the maturity phase of the product life cycle where a product has now been adopted by most of the consumers who will, leaving little opportunity for growth. Some trends will reverse themselves. For example, in the late 1990s, a number of people invested in ostriches, driving up the price. Ostrich meat was touted as offering a taste similar to red meat but with much lower fat content. Owners bred the ostriches hoping for greater profits from selling ostriches to others. When the stocks were large enough that it was time to try to actually sell the meat, however, the “bottom fell out” of the market, resulting in a sharp decline in value. Much the same thing happened in the Internet stock market during the 1990s.

A special kind of trend involves seasonality. Turkey and cranberries are consumed disproportionately during November and December in the U.S. Prices of fresh peaches reach very high levels during the winter months, where much of the supply is imported, and drop dramatically during the summer months. It is possible to “partition” such seasonal effects from a long term trend:

When one adjusts for seasonal effects, this chart shows a consistent upward trend.

Lags in response to market conditions. A free market economy is based on the idea that the buyers and sellers will respond to changes in the market. When it is no longer profitable to produce and sell the current quantity, sellers will want to cut back on production. When prices rise due to high levels of demand, seller will want to increase capacity to produce a greater quantity. In practice, however, adjusting takes place. If the price of beef goes up, it will take time to raise more cattle to be slaughtered. In the short run, the farmer may actually produce less because cattle are held back for breeding rather than being sold off for meat. When prices go down, the farmer has already invested in facilities and/or the current crop. Thus, it will take time to adjust production. Ironically, the adjustment phase may take so long, and too many farmers may “jump on the bandwagon,” that by the time the adjustment has taken place, the trend may have reversed. For example, if farmers see an attractive market for almonds, they may grow more almond trees. By the time these trees are ready to yield, however, the price may have declined. Too many farmers may have grown too many trees, flooding the market. Many farmers may then rip up their trees and grow other commodities, forcing supply down and prices up, encouraging a new round of investments!

It takes time to recognize that prices are consistently going up or down (as opposed to just fluctuating). Implementing the capacity change then takes time, and it may be necessary to secure a loan or other capital before the investment can be begun. It may take some time for prices to be felt at the different ends of the value chain or channel. For example, if the wholesale supply price of peanut butter goes up, peanut farmers who contracted in advance to sell at a given price may not feel the price change until it becomes time to negotiate for next year’s contract.

“Real” vs. inflation-adjusted prices. Inflation is a reality. Over time, average prices tend to go up dramatically. Measures of inflation—such as the U.S. Consumer Price Index—are based on weighing the cost of a “basket” of goods. Different expenditures felt by a typical family—such as food, housing, medical care, and transportation—are each weighted in arriving at an estimate of overall price changes. Often, however, inflation rates vary dramatically between product categories. Some components of the economy—such as health care and real estate—have very high rates of inflation while the costs of many electronic products are actually declining. Changes in the prices of different agricultural products often vary considerably by category. To make price comparisons meaningful over time, we can adjust for inflation. If we set an arbitrary year to be our “index” year, we can more meaningfully compare economic data over time.